Are you puzzled by the difference between cost allocation plans and indirect cost rates? You’re not alone. Indirect costs are often one of the most confusing and misunderstood concepts in financial management. But MGT is here to help! We’ve created this blog to help you ensure your agency allocates costs correctly (while remaining compliant with appropriate regulations), so you can get the most out of your budget and fulfill your agency’s mission.

First things First, Do You Have a Choice?

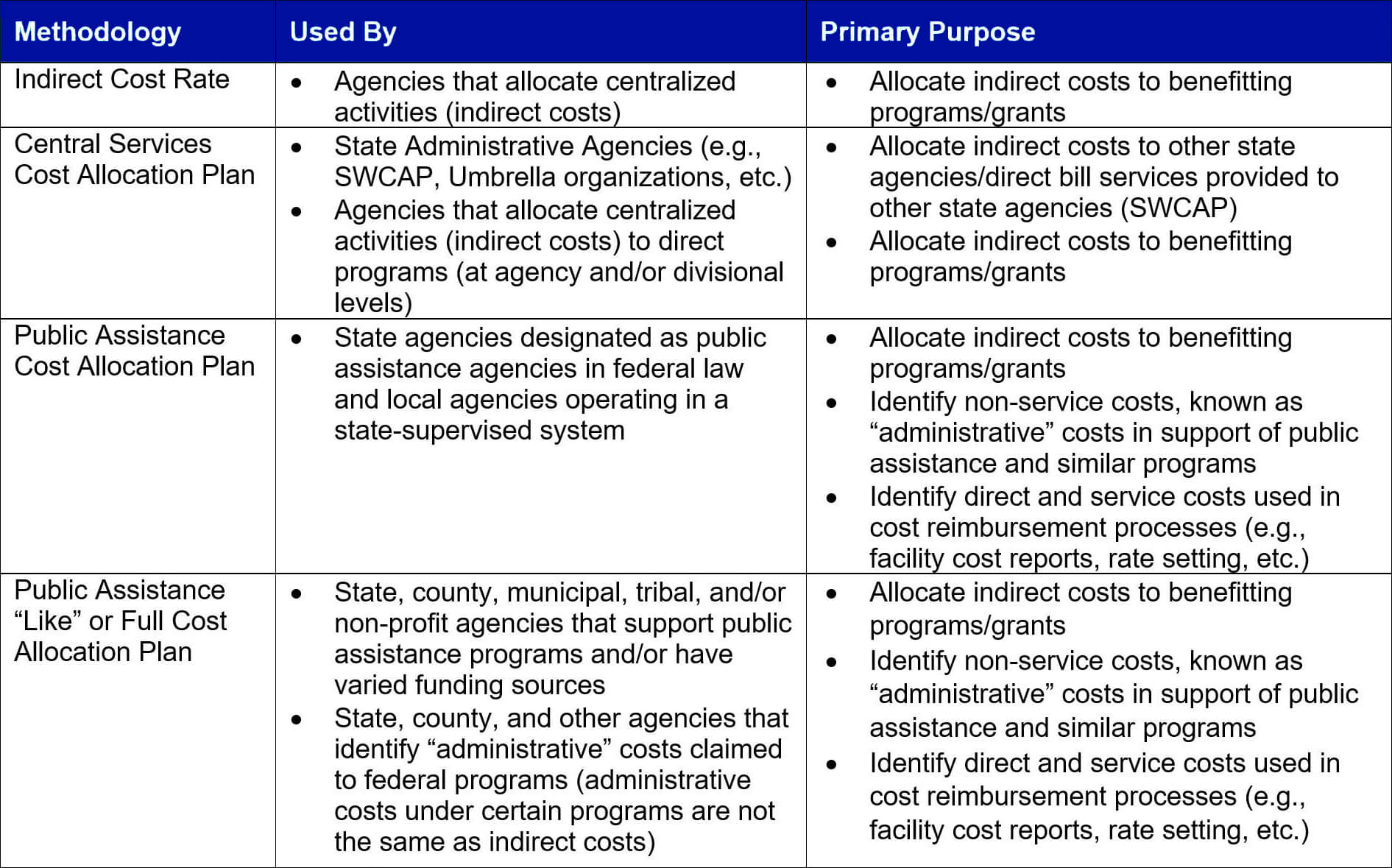

If your agency receives federal funds or pass-through funds via another agency you may have a choice in indirect cost allocation methods. Options range from indirect cost rates to types of cost allocation plans. If your state agency is not identified as a public assistance agency according to the Code of Federal Regulations (CFR), you may not be required to prepare a public assistance cost allocation or plan. The same may hold true for certain county and municipal agencies depending on the overall state structure in which the entity resides, the activities performed, and the particular funding sources. Note that for the purposes of this discussion, “full cost allocation plan” means one that allocates all costs with the exception of direct client or vendor payments rather than a type of central services cost allocation plan.

How Do You Decide Between an Indirect Cost Rate or a Cost Allocation Plan?

Indirect cost rates and cost allocation plans both identify and allocate indirect costs. Classic examples of indirect costs include human resources (HR), motor pools, and the agency director. A simple indirect cost rate treats indirect costs equally and produces a percentage that is applied to direct or programmatic functions. For example, if the rate is 22%, an agency applying for a grant will reserve 22% for indirect costs or budget $22 for indirect costs for every $100 received.

Agencies may prepare more complex and/or multiple indirect cost rates. A larger agency might have an indirect cost rate for high-level supporting functions, such as HR and calculate individual rates for each division. Thus, a grant within an environmental services division of a public health agency might be allocated 8% for agency indirect and 12% for division indirect costs. A different division of the same agency might see that same 8% related to costs that benefit the entire organization, but their divisional indirect rate might be 15%.

If an agency is small, with only a handful of “direct” activities, indirect cost rates work well. Where it starts to get messy is when an organization has a variety of funders with different cost recovery mechanisms. When an agency is larger, indirect cost rates do not do a great job of measuring “level of effort”. The point of an indirect cost rate or a cost allocation plan is to approximate the level of effort that certain functions support the overall organization. Going back to our Human Resources example, a single indirect cost rate that includes Human Resources might net 8%. But across divisions within the organization, the 8% might not be equitable. And while it may be equitable for Human Resources, it may not be for legal staff, policy staff, information technology, specialized financial functions, and so forth.

A cost allocation plan treats each supporting function separately. It looks at each function and determines a specific allocation method to more discreetly allocate each function of the divisions, programs, grants, and so on. As a result, indirect and other costs are allocated in a more targeted manner. There is also more transparency. Even if functions are allocated using the same method, the plan will show exactly how much Human Resources, legal, or motor pool costs are allocated to each division, program, grant, etc. (rather than boiling it down into a single percentage). A cost allocation plan will also identify the non-indirect costs or administrative costs that are incurred in support of many programs. For many large grants, administrative costs to operate programs are distinct from indirect costs and must be identified and reported as a condition of receiving a grant. Identifying these costs is something that an indirect cost rate simply cannot do.

What Your Agency Needs to Consider

In a small organization, staff may wear multiple hats. Staff may perform payroll and other accounting functions, but all functions support the entire agency. Thus, the indirect cost rate may still comply with federal regulations. But, if your agency has multiple divisions, programs, and funding sources, support functions tend to be more specialized. There will be staff who aren’t really indirect across the agency but get stuck in the middle and need specialized allocation methods to allocate their costs across only those programs they support. Now, an indirect cost rate will not identify their level of effort, will not comply with all regulations, and likely will not maximize funding.

Also, it can be tricky at this point to figure out whether an individual or function represents an “indirect” or “direct” cost. If an individual is supporting staff working on several grants, you need to determine if they are the base or numerator of the rate calculation. A cost allocation plan avoids this discussion altogether by looking at each function, and in some cases each individual, and determining the appropriate allocation method for the function. At this point, it is often easier to employ a full cost allocation plan.

If you decide a cost allocation plan is the way to go, then you need to select what type of plan is best for your agency. A central services cost allocation plan identifies specific functions and allocates them discretely, but it only identifies and allocates the indirect functions, either at the agency wide and/or divisional levels.

A “full” cost allocation plan identifies every single cost incurred by an agency and allocates it to a benefitting program, regardless of whether it is a direct or indirect cost. Thus, every function of an agency is reviewed and allocated. The “full” or public assistance-like cost allocation plan usually follows the requirements or process for a public assistance agency cost allocation plan. It is used because usually these plans identify costs that are recovered to public assistance programs. Public assistance-like cost allocation plans, at least in narrative form, are required to claim costs to programs such as Medicaid. There are some funders who prefer rates. In this case, certain results of the plan can be expressed as a rate or rates. This practice is common for a public or behavioral health agency that claims administrative costs to the Medicaid agency but also receives a number of direct grants.

Reporting requirements tied to the CARES Act, American Rescue Plan, and specific programs, and upcoming guidance on equity reporting all necessitate conscious decisions about what process is the best for your organization. At the very least, it may be necessary to amend practices in order to ensure compliance with new regulatory and programmatic requirements.